Personal Fundings For Bad Credit History Are A Wonderful Alternative For Individuals With An Inadequate Credit History

Content writer-Guzman Eliasen

These loans can aid people with a reduced credit report obtain the cash they require. These loans are often unsecured and also have actually dealt with rate of interest. You can also find many alternatives that will certainly benefit you if you do not have the excellent credit rating. There are link web page of these loans. Safe as well as unsecured. Each has its very own advantages and negative aspects.

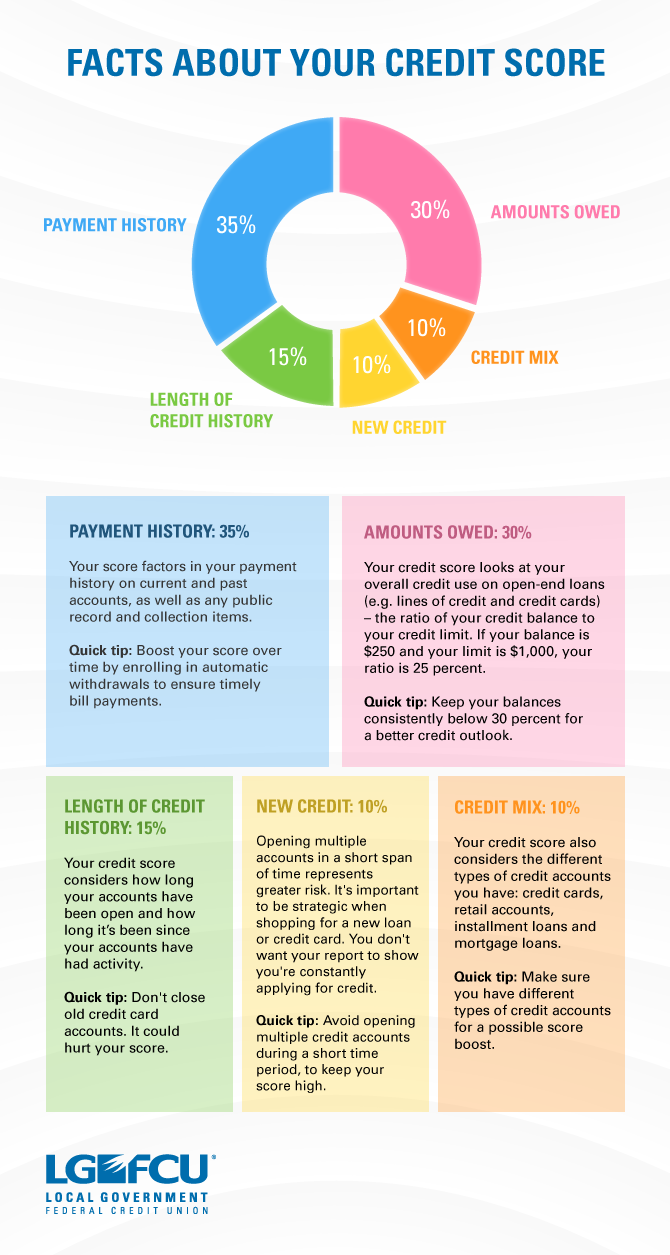

A personal finance with poor credit rating is an option for people with poor debt. This kind of funding will certainly cost less than most various other choices. It will certainly additionally aid your credit report since lending institutions will certainly be considering your settlement history. If you are attempting to repair your debt, obtaining an individual financing is a fantastic means to begin. Your credit report is based on your repayment history, so you can not manage to have a poor one.

You can likewise get a poor credit score lending from a co-signer with good credit scores. This sort of car loan is much more economical since the lender does not need to risk his or her residential or commercial property. However, it may take longer to obtain a loan because of the high interest rate. This type of funding is usually temporary as well as you can repay it over 2 to 7 years. Yet it's worth it if you do not have great credit history.

While an individual lending with bad credit rating can be expensive, it is most likely to be the most effective choice for people with poor debt. These car loans normally have reduced rate of interest than other options as well as will assist you rebuild your credit history. The advantages of these fundings are that they can aid you fix your debt. You can utilize them to pay off your expenses, pay off high rate of interest financial obligation, and fix your credit history. These fundings are typically the most effective choice for people with negative credit rating, so you need to take into consideration requesting one today.

There are a few options for bad debt personal finances. One of these is an on the internet loaning network. This network links borrowers with a variety of lenders and also lets you send one application. Alternatively, you can see your neighborhood financial institution or cooperative credit union and also use straight to a loan provider. As long as you have good monetary standing, you need to have the ability to get a personal finance for bad credit scores. These finances can be an excellent way to repair your credit report.

Bad credit rating personal fundings can be discovered with the internet. You can contrast various deals and also select the one that matches your requirements best. no credit check cash advance loans online can be used for different functions. A poor credit report car loan can be utilized for emergency situation situations. It is hard to obtain a loan with negative credit score, yet it is feasible to obtain one. You need to understand just how to make an application for a bad credit history funding as well as the guidelines that are involved. You can contrast the interest rates of numerous business on the internet to guarantee that you're obtaining the most affordable rates of interest.

Personal Finances For Bad Credit score are unsafe loans that call for security. These loans can be made use of to pay for a variety of points. These lendings are temporary, and also can be authorized in one day. They commonly have high interest rates, however you can still obtain them. This makes them a choice for individuals with inadequate credit rating. The most effective way to obtain a poor credit rating funding is by getting one online. When you use, make sure you understand your credit report. Having try this web-site does not make you disqualified for a car loan, yet it will certainly help you find the ideal personal loan.

Along with protected fundings, you can also locate unsafe individual car loans for negative credit score. These kinds of personal fundings are normally shorter-term loans, which indicates they will certainly require security. In addition, they will certainly lug higher interest rates than protected finances. So, it's important to examine the financing's conditions to ensure you're getting the appropriate financing. Yet if you're uncertain which type of car loan is the best fit for you, don't worry. These finances will certainly aid you obtain the money you require without damaging your credit.